Medical equipment depreciation calculator

This depreciation calculator will determine the actual cash value of your Defibrillator using a replacement value and a 7-year lifespan which equates to 007 annual depreciation. This depreciation calculator will determine the actual cash value of your Oximeter using a replacement value and a 7-year lifespan which equates to 007 annual depreciation.

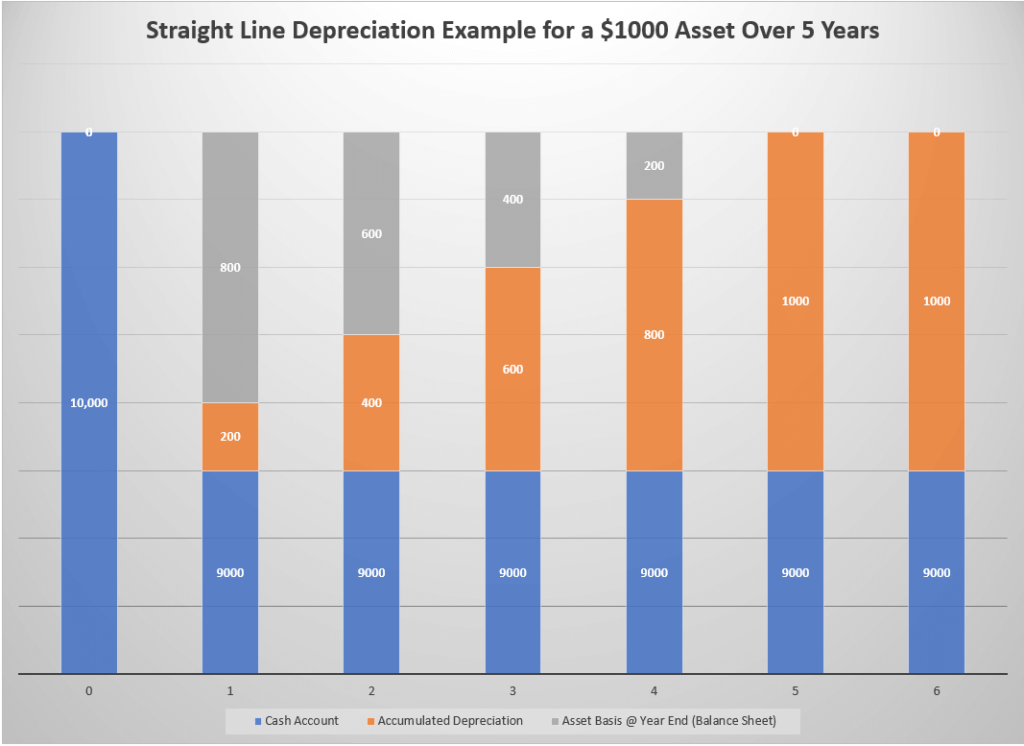

Straight Line Depreciation Accountingcoach

The book value approach may be suitable for relatively newer.

. Depreciation remaining asset lifetime SYD x cost value salvage value Bear in mind that the SYD value is the sum of all useful life years. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual. You can browse through general categories of items or begin with a keyword search.

To calculate the SYD use the following formula. There are many variables which can affect an items life expectancy that. Bedside cabinetslockers carts and poles blanket warming cabinets blood warming cabinets medical refrigerators and overbed.

The calculator should be used as a general guide only. Depreciation calculators online for primary methods of depreciation including the ability to. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

PrimedeQ is an e-Marketplace for buying selling renting servicing and spares of medical equipment. 7 6 5 4 3 2 1 28. This depreciation calculator will determine the actual cash value of your MRI Scanner using a replacement value and a 5-year lifespan which equates to 005 annual depreciation.

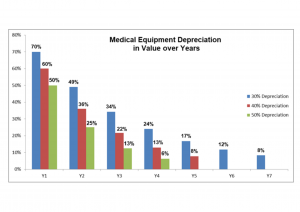

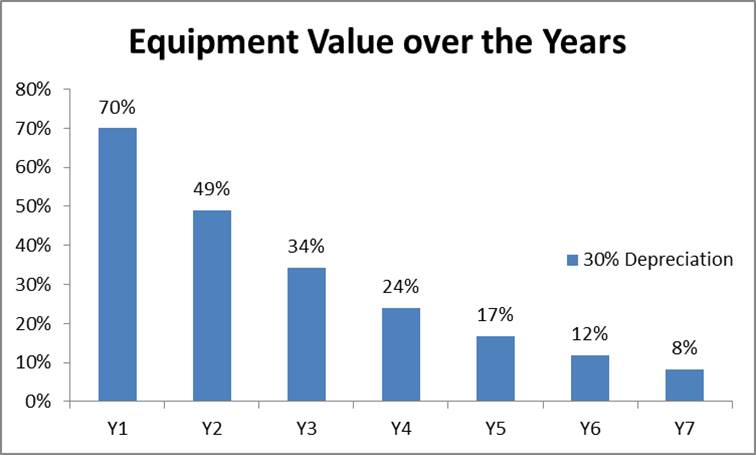

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. ATO Depreciation Rates 2021 Medical ATO Depreciation Rates 2021 Medical 122. The IT rate applicable for most medical equipment is 30-50 and hence depreciated over 4-7 years.

High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only. This depreciation calculator will determine the actual cash value of your Temperature Monitor using a replacement value and a 7-year lifespan which equates to 007 annual depreciation. There are many variables which can affect an items life expectancy that should be taken into consideration.

Next youll divide each years digit by the sum. In other words the. We offer all types of used refurbished medical equipment including A.

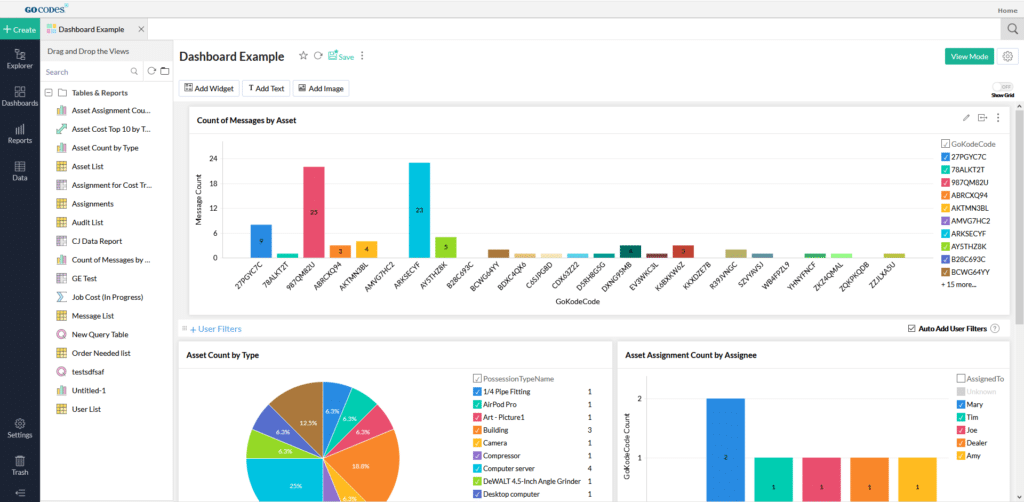

Calculate Market Value About the Market Value Calculator In an effort to provide our users with the most useful and up-to-date features for buying and selling used medical equipment and in. The Depreciation Calculator computes the value of an item based its age and replacement value. This depreciation calculator will determine the actual cash value of your Doppler using a replacement value and a 7-year lifespan which equates to 007 annual depreciation.

Facility equipment wont last forever so its important for facility managers to determine the average number of years an asset will be useful before its value is fully depreciated.

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Overview How It Works Example

Yearly Comparison Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Balance Sheet Reconciliation

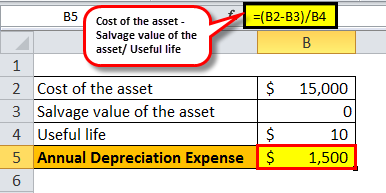

How To Calculate Depreciation Expense For Business

Used Medical Equipment Valuation How Much Should You Pay

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Medical Equipment Value At 30 Depreciation Rate Primedeq Blog

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

What Is Equipment Depreciation And How To Calculate It

What Is Equipment Depreciation And How To Calculate It

What Is Equipment Depreciation And How To Calculate It

Depreciation Of Building Definition Examples How To Calculate

Straight Line Depreciation Accountingcoach

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

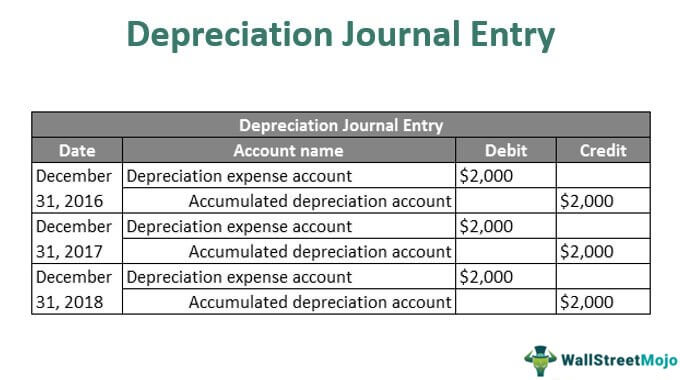

Depreciation Journal Entry Step By Step Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Journal Entry Step By Step Examples